Managing your money can feel overwhelming, but with the right budgeting tips, anyone in the USA can take control of their personal finances. A smart budget helps you save money, reduce debt, and build a secure future. Whether you are just starting out or want to improve your financial habits, these tips will guide you step by step.

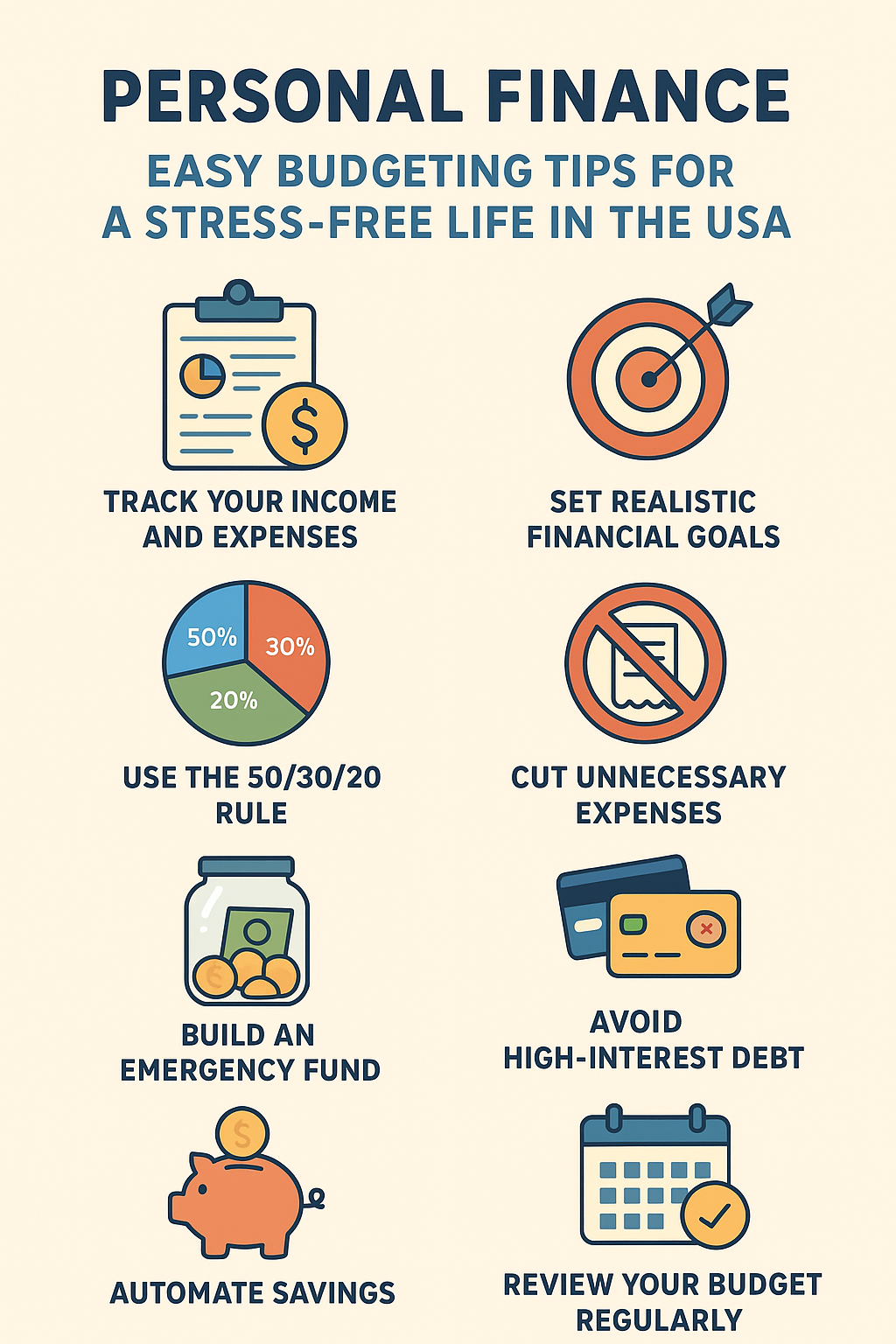

1. Track Your Income and Expenses

Understanding where your money goes is the first step to better personal finance. Start by tracking your income from all sources and noting every expense. Use apps like Mint, YNAB (You Need a Budget), or even a simple spreadsheet. Categorize your spending into essentials (rent, groceries, utilities) and non-essentials (entertainment, dining out).

2. Set Realistic Financial Goals

Without goals, budgeting can feel pointless. Set short-term goals like saving $500 in three months and long-term goals like buying a home or saving for retirement. Clear goals give you motivation and direction.

3. Use the 50/30/20 Rule

A popular budgeting strategy is the 50/30/20 rule:

- 50% of income for needs (rent, groceries, bills)

- 30% for wants (shopping, movies, dining out)

- 20% for savings and debt repayment

This method balances spending and saving without feeling restricted.

4. Cut Unnecessary Expenses

Review your monthly expenses and identify areas to save. Cancel unused subscriptions, reduce dining out, or switch to cheaper services. Small changes add up over time and improve your financial health.

5. Build an Emergency Fund

Life is unpredictable. An emergency fund of 3–6 months’ worth of expenses ensures you are prepared for unexpected costs like medical bills or car repairs. Keep this money in a separate high-yield savings account.

6. Avoid High-Interest Debt

High-interest debt, like credit card debt, can derail your financial plans. Pay off debts as quickly as possible, and avoid new loans unless necessary. Consider the debt snowball or debt avalanche method to pay off balances efficiently.

7. Automate Savings

Automate your savings to make it easier. Set up automatic transfers to a savings account or retirement fund each month. This ensures you save consistently and don’t rely on willpower alone.

8. Review Your Budget Regularly

Life changes, and so should your budget. Review it monthly to adjust for new expenses, increased income, or changing goals. Regular tracking helps you stay on track and maintain financial discipline.

Final Thoughts

Budgeting doesn’t have to be stressful. By tracking expenses, setting clear goals, and saving consistently, anyone in the USA can achieve financial freedom. Start small, stay consistent, and watch your money work for you.

http://Best Car Insurance in the USA (2025): Affordable Plans, Benefits & Tips”

http://Title :10 Smart Money Habits Every American Should Start Today